are funeral expenses tax deductible on 1041

These deductible expenses include. Hi and welcome to our siteFuneral expenses are not deductible for income tax purposes on form 1041but may be deducted for estate tax purposes on form.

The federal government does not allow taxpayers to deduct funeral expenses on their personal income tax returns.

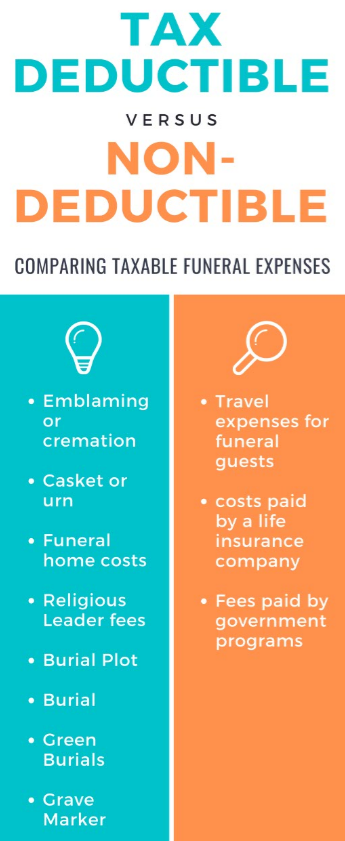

. The costs of funeral expenses including embalming cremation casket hearse limousines and floral. If there is an executor the Form 1041 filed under the name and TIN of the related estate for the tax year in which the election terminates includes a the items of income deduction and. Legal expenses for probate are deductible but they are deductible to the estate on the estates income tax return Form 1041 if required to file them.

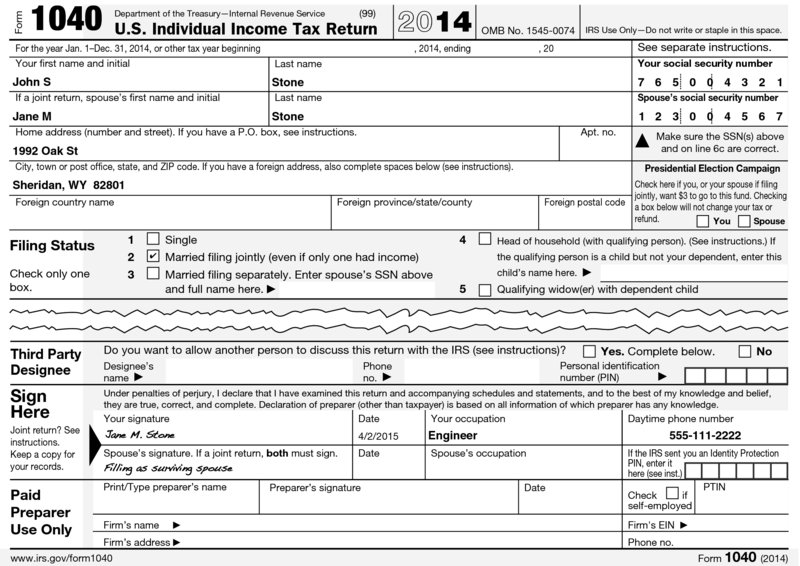

Individual taxpayers cannot deduct funeral expenses on their tax return. The IRS limits funeral deductions to. No deduction for funeral expenses can be taken on the final Form 1040 or 1040-SR of a decedent.

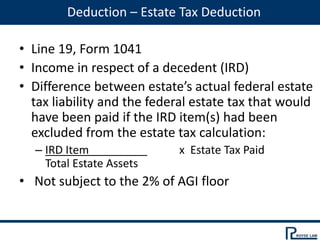

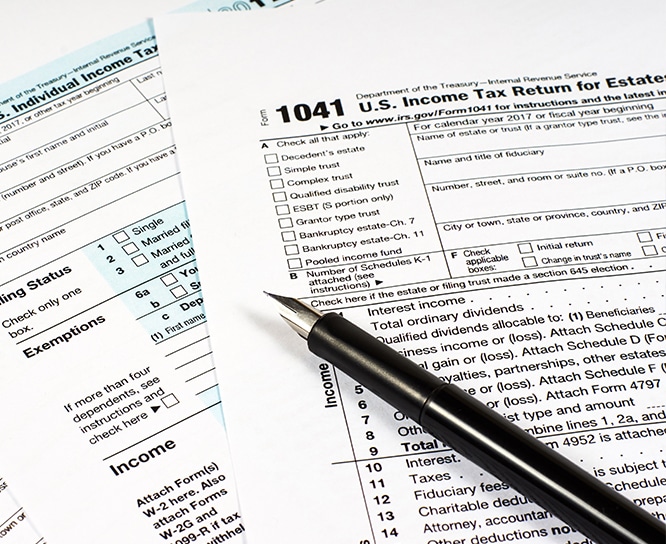

The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or on the Form 706 which is the federal estate tax return. What expenses are deductible on estate tax return. 2 Best answer.

Estate income is reported on Form 1041 and this form allows your executor to claim your funeral expenses as a deduction as well. In order for funeral expenses to be deductible you would need to. March 21 2021 827 AM.

These need to be an itemized list so be sure to track all expenses. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. Regardless the executor is entitled to reimbursement.

Funeral expenses are not deductible for income tax purposes. Medical expenses of the. If you paid the legal fees.

While the IRS allows deductions for medical expenses funeral costs are not included. But for estates valued above 114 million in 2019 or 1158. This is due within nine months of the deceased persons.

These expenses may be deductible for estate tax purposes on Form 706. Yes but the ordinary and necessary expenses incurred are deductible by the estate on its 1041 if one were filed. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or on the Form 706 which is the federal estate.

The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or on the Form 706 which. Medical expenses of the decedent paid by the estate may be deductible on the. This guide will explain when funeral expenses are tax-deductible which ones qualify and how to claim them.

The routine type of deductions are mostly self-explanatory see screenshot. Estates worth 1158 million or more need to file federal tax returns. No you are not able to claim deductions for funeral expenses on Form 1041.

The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or on the Form 706 which. Funeral expenses arent tax deductible for individuals and theyre only tax exempt for some estates. What funeral expenses are deductible on estate tax return.

The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or on the Form 706 which is the federal estate tax return. Yes except for medical and funeral expenses which you do not deduct on Form 1041. Schedule J of this form is for funeral expenses.

However funeral expenses are simply not. Deducting Final Medical Expenses. They may be deducted for estate tax purposes on either a Federal or State estate tax return.

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

Federal Fiduciary Income Tax Workshop

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

Are Funeral Expenses Tax Deductible The Financial Guide

Boca Raton Estate Tax Returns Florida Probate Law Firm

Decedents Dealing With The Death Of A Family Member

![]()

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

10 Tax Deductible Funeral Service Costs

Are Funeral Expenses Tax Deductible Funeralocity

Irs Instructions For Form 1041 And Schedules A B G J And K 1 2017 2022 Fill Out Tax Template Online Us Legal Forms

Income Tax Return For Estates And Trusts

Solved This Problem Is For The 2019 Tax Year Prepare The 2019 Fiduciary Income Tax Return Form 1041 For The Green Trust In Addition Determine Course Hero

Instructions On Filling Out Irs Form 1041

How To Deduct Interest And Taxes For A Decedent Estate Or Trust Dummies

Timely Topics For Attorneys Ppt Download

Video Guide To A Fiduciary Income Tax Return Turbotax Tax Tips Videos

Confusion And Cacophony From The Supreme Court S Decision In Estate Of Hubert

/184283932-56a044915f9b58eba4af9970.jpg)

Form 1041 U S Income Tax Return For Estates And Trusts Guide